The Excel add-in allows you to quickly and automatically check entities (contractors) from the Excel spreadsheet in terms of their current status in the VAT register, the VIES system and the REGON (GUS) register. The latest version of the app also allows checking bank accounts contractors published on the so-called white list of VAT taxpayers. Using the add-on, it is also possible to download detailed company data directly from the REGON state register.

This chapter contains instructions for integrating Microsoft Excel with the system nip24.pl. The provided add-in (Add-In) has been successfully tested in the following versions of MS Excel: 2007, 2010, 2013, 2016, 2019 (on Windows and MacOS operating systems) and 2021 (on Windows and MacOS operating systems) and the browser version of Excel365.

The latest version of the add-in for Excel 2007, 2010, 2013, 2016 is always available for download from the website Download. The add-in can be installed in both 32-bit and 64-bit versions of Excel. Attention! Please select version (32 or 64 bit) compatible with the version of the Excel application, not the operating system.

Attention! Unfortunately, the Excel add-in available on our website - for older versions of the application - is incorrectly recognized by some antivirus software (AV) as a so-called "false positive" - here is detailed information about this phenomenon: https://excel-dna.net/2022/03/07/excel-dna-1-6-net-6-packagereference-anti-virus/. Of course, the software available on our websites is free of malware, but on the website below you can check which antivirus (AV) program has a "false positive" problem: https://www.virustotal.com/gui/file/cef2bed612ff84ce31a298f68d3be0eaa9cf6b75cc3dafcc0eaddfe89a00e869/detection

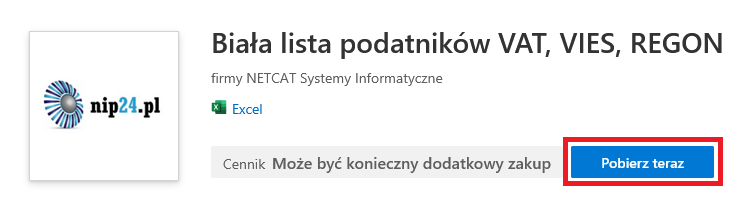

To download and install the add-in for Excel 2019, 2021 and Excel365 versions, please visit the official Microsoft store: https://appsource.microsoft.com.

You can check the full functionality of the Excel add-in - without having to create an account - using the shared one Test API.

Using the add-on in a production environment requires creating an account on nip24.pl, purchasing at least the Business plan and generating a key and its identifier. The process of registering and creating an account and generating keys is described on the website Documentation.

Installation and configuration for MS Excel 2019, 2021 and Excel 365

Microsoft Store

Installation

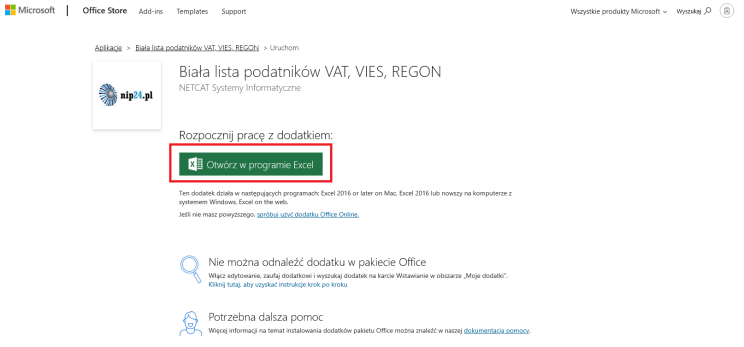

After entering the official Microsoft store website: https://appsource.microsoft.com click the button download now.

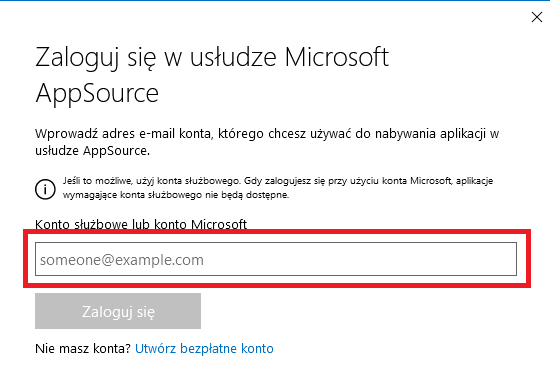

A login window will appear in which you must enter the e-mail address for which you have a Microsoft account (private or corporate). If you do not have such an account, you can create one and continue the installation process or interrupt the installation and install the add-on in one of the ways described above:

After successfully logging in to your Microsoft account, the next step is to launch the add-in from the Excel application. Click the button Open in Excel:

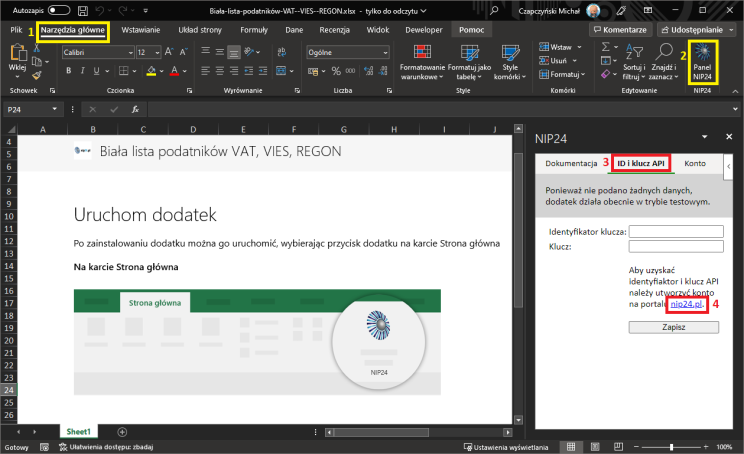

After opening the Excel application, you should see a screen similar to the one shown below:

Configuration

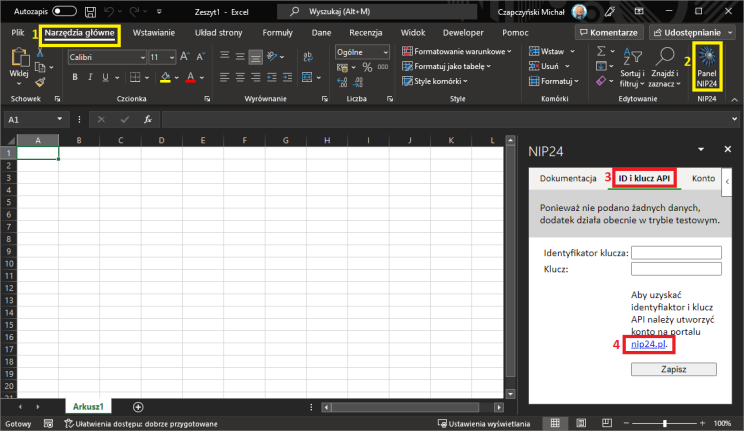

In menu Main tools [1], find the icon representing Panel NIP24 [2] and click on it to make the side panel visible. Immediately after installation, the add-on is configured to work in a test environment - details on the website Test API. Using the add-on in test mode does not require creating an account on nip24.pl.

To switch the add-on to the production environment, click on the tab ID and klucz API [3] and enter Key ID and Key, which you can find after logging in to your account on the nip24.pl website in the "Klucze API". After entering both values, press the button Zapisz.

If you do not have an account on our website yet, please click the link nip24.pl [4] and complete the registration process, which is described in detail on the website Documentation.

Excel 2019/2021

Installation

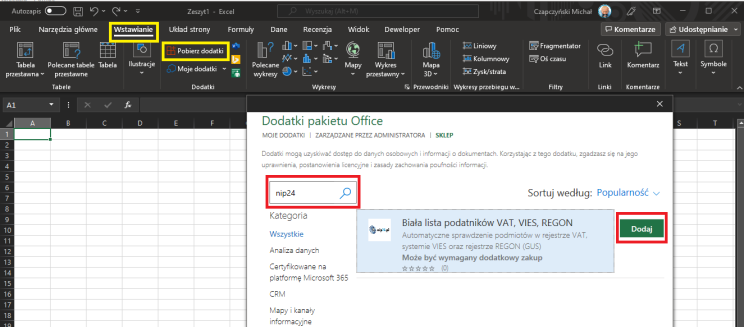

To download and install the add-in from the Excel 2019 or 2021 version, go to the tab Inserting, find the Add-ons section and click the button Download add-ons. Then, in the opened window, enter the word 'nip24' in the search field and press the magnifying glass icon. You should find an add-on called "White list of VAT, VIES, REGON taxpayers", which should be installed by clicking the button Add. All the above steps are illustrated in the screenshot below:

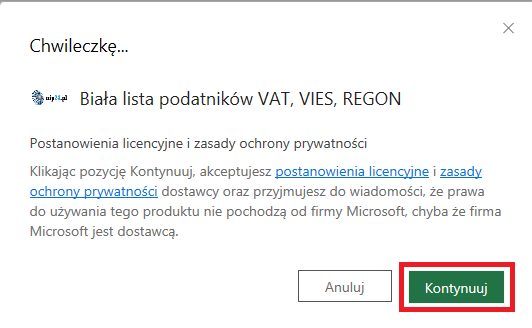

After clicking the Add button, a screen should appear where you can read the license terms and privacy policy. Both documents are in English. The Polish version of the documents is included in the applicable one Regulations.

Press the button Continueto install the add-in in Excel.

Configuration

After correctly installing the add-on, a screen similar to the one presented below should appear:

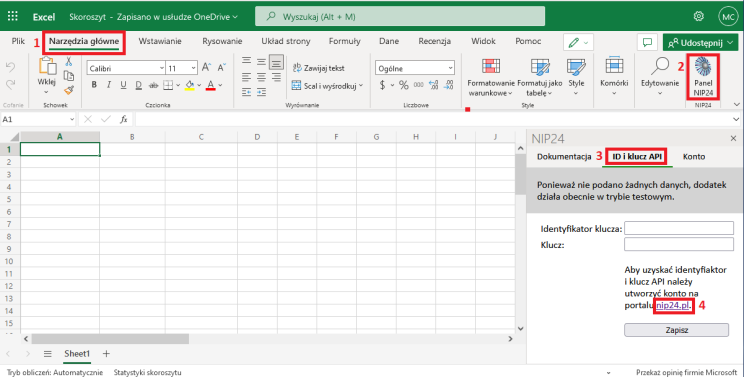

In menu Main tools [1], find the icon representing Panel NIP24 [2] and click on it to make the side panel visible. Immediately after installation, the add-on is configured to work in a test environment - details on the website Test API. Using the add-on in test mode does not require creating an account on nip24.pl.

To switch the add-on to the production environment, click on the tab ID and klucz API [3] and enter Key ID and Key, which you can find after logging in to your account on the nip24.pl website in the "Klucze API". After entering both values, press the button Zapisz.

If you do not have an account on our website yet, please click the link nip24.pl [4] and complete the registration process, which is described in detail on the website Documentation.

Excel 365

Attention! The Excel 365 web version add-in has been successfully tested on the latest versions of the 4 main web browsers:

Chrome– Version 106.0.5249.119 (Official Version) (64-bit),FireFox– Version 105.0.3 (64 bits),Opera– Version 91.0.4516.65Edge– Version 106.0.1370.42 (Official build) (64-bit).

Installation

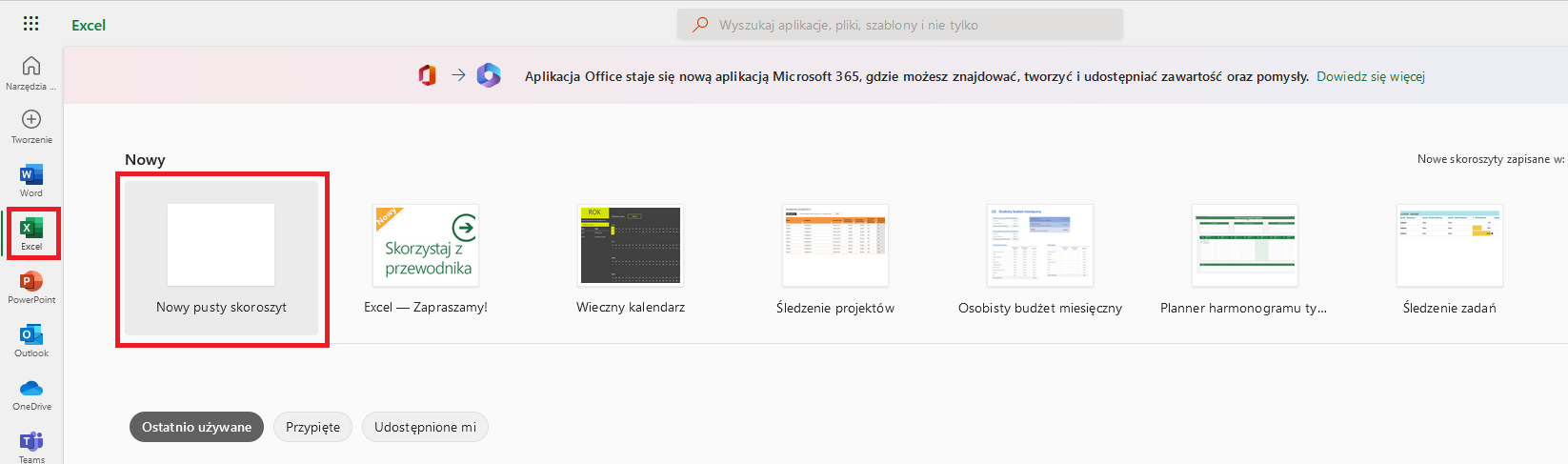

Regardless of the browser type, the installation and configuration process is the same. Launch your web browser and go to the website Microsoft Office Home Page and sign in to your Microsoft account. Then select the application from the left menu Excel and create New blank workbook:

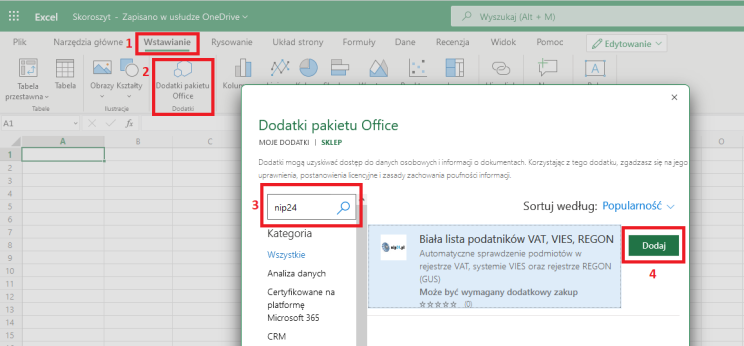

To download and install the add-in from the Excel 2019 or 2021 version, go to the tab Inserting [1], find the Add-ons section and click the button Office Add-ins [2]. Then, in the opened window, enter the word 'nip24' [3] in the search field and press the magnifying glass icon. You should find an add-on called "White list of VAT, VIES, REGON taxpayers", which should be installed by clicking the button Add[4]. All the above steps are illustrated in the screenshot below:

Configuration

After correctly installing the add-on, a screen similar to the one presented below should appear:

In menu Main tools [1], find the icon representing Panel NIP24 [2] and click on it to make the side panel visible. Immediately after installation, the add-on is configured to work in a test environment - details on the website Test API. Using the add-on in test mode does not require creating an account on nip24.pl.

To switch the add-on to the production environment, click on the tab ID and klucz API [3] and enter Key ID and Key, which you can find after logging in to your account on the nip24.pl website in the "Klucze API". After entering both values, press the button Zapisz.

If you do not have an account on our website yet, please click the link nip24.pl [4] and complete the registration process, which is described in detail on the website Documentation.

Installation and configuration for MS Excel versions: 2007, 2010, 2013 and 2016

Installation

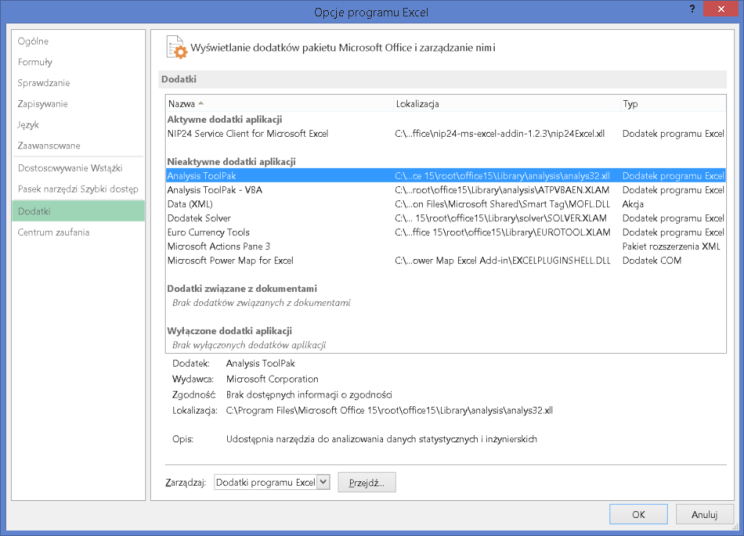

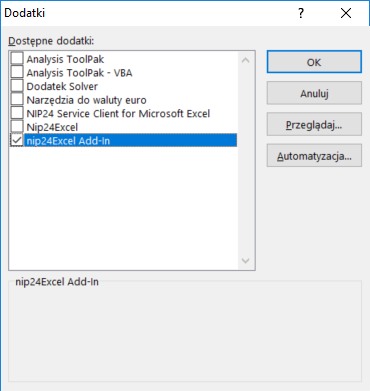

Launch the MS Excel application and go to File > Options, then select from the menu Accessories.

At the bottom of the settings you need to select Excel add-ins and click the button Go. In the window Accessories, click the button Browse, go to the directory where the file was unpacked nip24-ms-excel-addin-nr_wersji.zip and indicate:

nip24Excel.xll– for 32-bit version of Excel,nip24Excel64.xll– for 64-bit version of Excel.

Correct loading of the add-in is illustrated in the figure below. Just click the button APPROXto make the features implemented in the add-in available in Excel.

Configuration

After installation, the add-on is configured for a test environment by default (more details on the tab Test API).

To be able to call the function in a production environment, it is necessary to configure access to the nip24.pl website once. To do this, go to any Excel sheet and execute the function:

=NIP24.POŁĄCZ.PRODUKCJA("identyfikator";"klucz")where the function parameters are:

identyfikator– the parameter should contain the identifier generated on the nip24.pl account (ID),klucz– the parameter should contain the key generated on the nip24.pl account (Key).

Details on generating the ID and key are described on the website Documentation.

ATTENTION! The above function replaces the old function: NIP24.ZAPISZ.ID.KLUCZ().

To verify the correctness of the connection to a given API (test or production), execute the function:

=NIP24.POŁĄCZENIE.STAN()Which can return values:

SUKCES: Produkcja– if the add-on is correctly configured to work with the production environment,SUKCES: Test– if the add-on is correctly configured to work with the test environment,BŁĄD: Połączenie wymaga konfiguracji– in case of incorrect configuration.

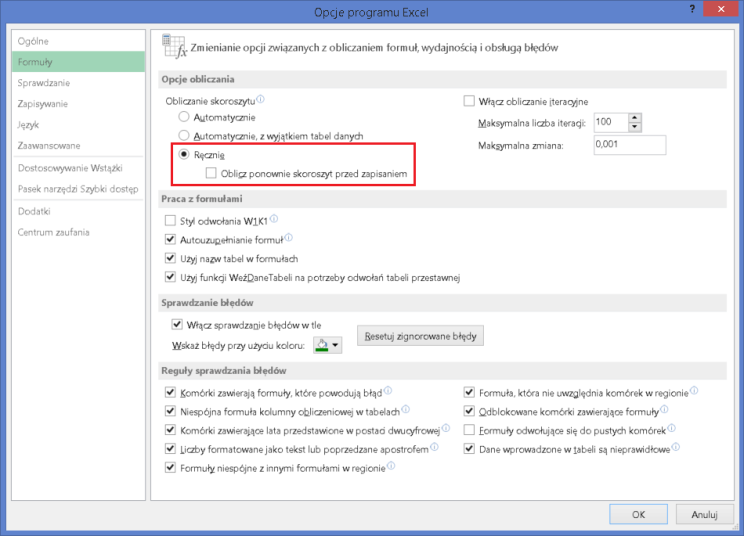

By default, every Excel document is set to automatically calculate the workbook. Setting this option implies calling all formulas if changes are made that affect a given formula. An example of this action is deleting a row in a worksheet. To avoid automatic calling of all functions defined in a given worksheet, which involves automatic sending of queries to the nip24.pl API, change the workbook calculation option to Manual:

- from the FILE menu, select Options

- select a bookmark Formulas.

- at section Calculation options select the setting: Manually and uncheck additional option: Recalculate the workbook before saving.

- save the changes made in the spreadsheet.

With the Excel sheet configured in this way, to force the refresh of all defined formulas, press the following key combination:

CTRL + ALT + SHIFT + F9Update the plugin to the latest version

Attention!The following procedure for updating the Excel add-in works correctly for MS Excel 2019, 2021 and Excel 365 versions, where the add-in can be installed from the Microsoft Store.

Attention! After installing the latest version, you must reconfigure the add-on, i.e. enter and save the ID and key.

To install the latest version of the Excel add-in, follow these steps:

1. Check the version of the installed add-in by calling the formula =NIP24.WERSJA(). The latest version of the add-on is 1.2.9-web

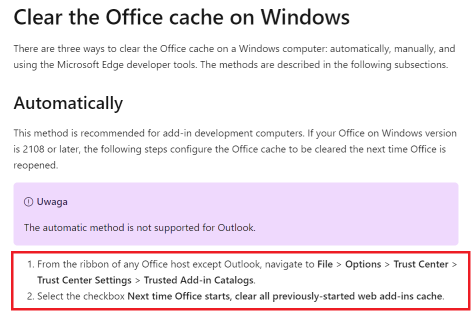

2. Clearing the MS Excel cache, according to the procedure described on the official documentation page: https://learn.microsoft.com/en-us/office/dev/add-ins/testing/clear-cache

3. After completing all steps from point 2, restart the MS Excel application.

4. During restart, the MS Excel application will download the latest version of the add-in from the Microsoft Store.

5. Configure the add-on by entering the ID and key downloaded after logging in to your account on our website – API Keys tab.

Usage

Before using the add-on, you should familiarize yourself with the specifics of its operation:

- All function calls are made in asynchronous mode, which does not cause freeze effect (no response) of Excel application.

- Adding (inserting) a row or column does not cause refresh all defined function calls.

- Copy or move cells containing functions does not cause refreshing defined function calls.

- Deleting a row or column refreshes all defined function calls and sends queries to nip24.pl (only in the case of default Excel settings). A description of how to change the default settings is included in the chapter Configuration.

- Attention! It is not recommended to run more than 500 parallel queries because Excel has difficulty handling large numbers of asynchronous calls.

A sample Excel file containing all the functions described below is attached to the ZIP file containing the Excel add-in.

Checking the company's business status

NIP24.CZY.AKTYWNA() – The function verifies and returns the current status of the company's operations. The parameters should be:

- Number TYPE (NIP, KRS or REGON),

- number consistent with the indicated type.

=NIP24.CZY.AKTYWNA("NIP";"7171642051")NIP24.CZY.AKTYWNA.NIP() – The function verifies and returns the current status of the company's activity for the provided Tax Identification Number. The parameters should be:

- NUMBER NIP.

=NIP24.CZY.AKTYWNA.NIP("7171642051")NIP24.CZY.AKTYWNA.REGON() – The function verifies and returns the current status of the company's activity for the given REGON number. The parameters should be:

- REGON NUMBER.

=NIP24.CZY.AKTYWNA.REGON("141715362")NIP24.CZY.AKTYWNA.KRS() – The function verifies and returns the current status of the company's activity for the given KRS number. The parameters should be:

- KRS NUMBER.

=NIP24.CZY.AKTYWNA.KRS("0000001280")Downloading company data necessary to issue an invoice

NIP24.DANE.FAKTURA() – The function collects the data necessary to issue an invoice. The parameters should be:

- Number TYPE (NIP, KRS or REGON),

- number consistent with the indicated type,

- (optional) FORMAT of the returned data (see: Tags that can be used as the FORMAT parameter).

=NIP24.DANE.FAKTURA("NIP";"7171642051")NIP24.DANE.FAKTURA.NIP() – The function retrieves the data necessary to issue an invoice for the given NIP number. The parameters should be:

- NUMBER NIP,

- (optional) FORMAT of the returned data (see: Tags that can be used as the FORMAT parameter).

=NIP24.DANE.FAKTURA.NIP("7171645051";"$(Name)")NIP24.DANE.FAKTURA.REGON() – The function retrieves the data necessary to issue an invoice for the given REGON number. The parameters should be:

- REGON NUMBER,

- (optional) FORMAT of the returned data (see: Tags that can be used as the FORMAT parameter).

=NIP24.DANE.FAKTURA.REGON("141715362";"$(Name) - $(LastName) $(FirstName)")NIP24.DANE.FAKTURA.KRS() – The function retrieves the data necessary to issue an invoice for the given KRS number. The parameters should be:

- KRS NUMBER,

- (optional) FORMAT of the returned data (see: Tags that can be used as the FORMAT parameter),

=NIP24.DANE.FAKTURA.KRS("0000001280";"$(Name)")Tags available in functions that retrieve data necessary to issue an invoice, which can be used as the FORMAT parameter:

$(NIP)– Entity's Tax Identification Number$(Name)- Company name$(FirstName)– Owner's name$(LastName)– Owner's name$(Street)– Street$(StreetNumber)– Property number$(HouseNumber)– Apartment number$(PostCode)- Zip code$(PostCity)- Post$(City)– Town

Default FORMAT: "$(Name), $(PostCode) $(City), $(Street) $(StreetNumber)/$(HouseNumber), NIP: $(NIP)”

If the string "JSON", the function will return the complete result as a string JSON, which can be freely parsed and further processed.

Downloading detailed company data

NIP24.DANE.PEŁNE() – The function retrieves all available entity data. The parameters should be:

- Number TYPE (NIP, KRS or REGON),

- number consistent with the indicated type,

- (optional) FORMAT of the returned data (see: Tags that can be used as the FORMAT parameter).

=NIP24.DANE.PEŁNE("NIP";"7171642051")NIP24.DANE.PEŁNE.NIP() – The function retrieves all available entity data for the given NIP number. The parameters should be:

- NUMBER NIP,

- (optional) FORMAT of the returned data (see: Tags that can be used as the FORMAT parameter).

=NIP24.DANE.PEŁNE.NIP("7171642051";"$(Name)")NIP24.DANE.PEŁNE.REGON() – The function retrieves all available entity data for the given REGON number. The parameters should be:

- REGON NUMBER,

- (optional) FORMAT of the returned data (see: Tags that can be used as the FORMAT parameter).

=NIP24.DANE.PEŁNE.REGON("141715362";"$(Name) - $(LastName) $(FirstName)")NIP24.DANE.PEŁNE.KRS() – The function retrieves all available entity data for the given KRS number. The parameters should be:

- KRS NUMBER,

- (optional) FORMAT of the returned data (see: Tags that can be used as the FORMAT parameter).

=NIP24.DANE.PEŁNE.KRS("0000001280";"$(Name)")Tags available in the NIP24.DANE.FULL functions that can be used as the FORMAT parameter:

$(Type)– Entity type$(NIP)– Entity's Tax Identification Number$(REGON)- REGON number$(Name)- Company name$(ShortName)– Short name$(FirstName)– Owner's name$(LastName)– Owner's name$(SecondName)– Owner's middle name$(Street)– Street$(StreetCode)– Street code TERYT$(StreetNumber)– Property number$(HouseNumber)– Apartment number$(PostCode)- Zip code$(PostCity)- Post$(City)– Town$(CityCode)– TERYT code of the town$(Community)- Community$(CommunityCode)– TERYT code of the commune$(County)- County$(CountyCode)– TERYT code of the district$(State)– Voivodeship$(StateCode)– TERYT code of the voivodeship$(CreationDate)– Date of establishment of the company$(StartDate)- Date of commencement of activities$(RegistrationDate)– Date of entry into the REGON register$(HoldDate)– Date of suspension of operations$(RenevalDate)– Date of resumption of operations$(LastUpdateDate)– Date of the last data update$(EndDate)– Date of termination of activity$(RegistryEntityCode)– Registration authority code$(RegistryEntityName)– Name of the registration authority$(RegistryCode)– Register or record code$(RegistryName)– Name of the register or record$(RecordCreationDate)– Date of creation of data in the register or records$(RecordNumber)– Identification number in the register or records$(BasicLegalFormCode)– Code of the basic legal form$(BasicLegalFormName)– Name of the primary legal form$(SpecificLegalFormCode)– Specific legal form code$(SpecificLegalFormName)– Name of the specific legal form$(OwnershipFormCode)– Ownership code$(OwnershipFormName)– Property name$(PKD)– List of PKD codes. The predominant activity is always displayed firstcode- PKD codedescription- Description of the given PKD codeprimary– The attribute informs whether a given code is the main (predominant) PKD code for a given activity. It can take logical valuestrue|falseversion– PKD code classification version. Possible values:2007|2015

$(Phone)– Company telephone number$(Email)– Company email address$(WWW)– Company website$(BusinessPartners)– Information about partners of a civil partnership

Default FORMAT: "$(Name), $(PostCode) $(City), $(Street) $(StreetNumber)/$(HouseNumber), NIP: $(NIP)”

If the string "JSON", the function will return the complete result as a string JSON, which can be freely parsed and further processed.

Checking the entity's status in the VIES system

NIP24.STATUS.VIES() – The function retrieves all available entity data directly from the VIES system. The parameters should be:

- European NIP number (EU VAT),

- (optional) FORMAT of the returned data (see: Tags that can be used as the FORMAT parameter).

=NIP24.STATUS.VIES(ZŁĄCZ.TEKSTY("PL";"7171642051"))Tags available in the NIP24.STATUS.VIES function that can be used as the FORMAT parameter:

$(UID)– Unique identifier generated by nip24.pl$(CountryCode)- Country code$(VATNumber)– European NIP number$(Valid)– Status$(TraderName)– Contractor's name$(TraderCompanyType)- Type of activity$(TraderAddress)– Contractor's address$(ID)– Unique identifier generated by the VIES system$(Date)– Date the response was generated$(Source)- Data source

Default FORMAT: "$(Valid)”

If the string "JSON", the function will return the complete result as a string JSON, which can be freely parsed and further processed.

Checking the entity's status in the VAT register

NIP24.STATUS.VAT() – The function returns the status of the entity in the VAT register. The parameters should be:

- Number TYPE (NIP, KRS or REGON),

- number consistent with the indicated type,

- (optional) FORMAT of the returned data (see: Tags that can be used as the FORMAT parameter).

=NIP24.STATUS.VAT("NIP";"7171642051";"$(Status)")NIP24.STATUS.VAT.NIP() – The function returns the status of the entity in the VAT register for the given NIP number. The parameters should be:

- NUMBER NIP,

- (optional) FORMAT of the returned data (see: Tags that can be used as the FORMAT parameter).

=NIP24.STATUS.VAT.NIP("7171642051")NIP24.STATUS.VAT.REGON() – The function returns the status of the entity in the VAT register for the given REGON number. The parameters should be:

- REGON NUMBER,

- (optional) FORMAT of the returned data (see: Tags that can be used as the FORMAT parameter).

=NIP24.STATUS.VAT.REGON("141715362")NIP24.STATUS.VAT.KRS() – The function returns the status of the entity in the VAT register for the given KRS number. The parameters should be:

- KRS NUMBER,

- (optional) FORMAT of the returned data (see: Tags that can be used as the FORMAT parameter).

=NIP24.STATUS.VAT.KRS("0000001280")Tags available in the NIP24.STATUS.VAT functions that can be used as the FORMAT parameter:

$(UID)– Unique identifier generated by nip24.pl$(Name)– Name of the verified company$(NIP)– NIP number of the verified company$(REGON)– REGON number of the verified company$(Result)– Descriptive status of the entity in VAT$(Status)– Numerical status of the entity in VAT$(Date)– Date the response was generated$(Source)- Data source

Default FORMAT: "$(Result)”

If the string "JSON", the function will return the complete result as a string JSON, which can be freely parsed and further processed.

Checking the status of an entity's bank account in the list of VAT payers (the so-called VAT white list) using API

NIP24.STATUS.IBAN("typ";"numer";"iban";["data"];["format"]) – The function checks the correctness of the contractor's bank account number in the list of VAT payers (the so-called white list of VAT payers) using API provided by the Ministry of Finance. The information is being downloaded directly With list of VAT payers (so-called VAT white list) of the Ministry of Finance. The parameters should be:

typ– number type, one of three possible values [NIP, KRS or REGON] allowed, after which the query will be asked,numer– value of the NIP, REGON or KRS number of the company for which the check is being carried out (required parameter),iban– verified company bank account number (required parameter) in the international IBAN format. Polish bank accounts begin with the country code PL, followed by the 26 digits of the account number. You can use space characters between groups of numbers. Attention! If the country code is not provided, the bill will be verified as Polish.data(optional) – the day on which the verification is to be performed (optional parameter, if it is not provided, the verification will be performed for the current day). Acceptable date format: "YYYY-MM-DD", (example: 2019-09-01),format(optional) – format of the returned data (see: Tags that can be used as the FORMAT parameter).

=NIP24.STATUS.IBAN("NIP";"7171642051";"PL49154000046458439719826658";"2019-09-01")NIP24.STATUS.IBAN.NIP("nip";"iban";["data"];["format"]) – The function checks the correctness of the contractor's bank account number in the list of VAT payers (the so-called white list of VAT payers) based on the NIP and IBAN numbers. The description of the input parameters is the same as for the function NIP24.STATUS.IBAN().

=NIP24.STATUS.IBAN.NIP("7171642051";"PL49154000046458439719826658";"2019-09-01")NIP24.STATUS.IBAN.REGON("regon";"iban";["data"];["format"]) – The function checks the correctness of the contractor's bank account number in the list of VAT payers (the so-called white list of VAT payers) based on the REGON and IBAN number. The description of the input parameters is the same as for the function NIP24.STATUS.IBAN().

=NIP24.STATUS.IBAN.REGON("472301670";"PL49154000046458439719826658";"2019-09-01")Additionally, functions have been prepared that make it possible to:

- Verifying the correctness of the IBAN number –

NIP24.IBAN.POPRAWNY(). - Standardization of the IBAN number –

NIP24.IBAN.NORMA().

Descriptions of both functions are included in the sections below.

Tags available in the above-mentioned functions, which can be used as the FORMAT parameter:

$(UID)– query ID from the nip24.pl system,$(NIP)– NIP number of the company for which the inquiry was made (return value only if the inquiry was made using the NIP number),$(REGON)– REGON number of the company for which the inquiry was made (return value only if the inquiry was made using the REGON number),$(IBAN)– standardized (without spaces) IBAN number of the contractor's bank account that was provided in the inquiry,$(Valid)– answer obtained from the Ministry of Finance: “Yes”/”No” (default if there is no format parameter),$(ID)– response (requestId) from the website of the Ministry of Finance. The requestId obtained in the response confirms the execution of the query and the obtained response,$(Date)– date of checking the connection between the NIP/REGON number and the contractor's bank account number (in the format: yyyy-mm-dd),$(Source)– information about the source URL (the address of the MF API interface or the name of the file used for verification).

Default FORMAT: "$(Valid)”

If the string "JSON", the function will return the complete result as a string JSON, which can be freely parsed and further processed.

Checking the status of an entity's bank account in the list of VAT payers (the so-called VAT white list) using a flat file

NIP24.STATUS.WHITELIST("typ";"numer";"iban";["data"];["format"]) – Unlike function NIP24.STATUS.IBAN(), which checks the status of the contractor's bank account using the API, function NIP24.STATUS.WHITELIST() checks the correctness of the contractor's bank account number in the list of VAT payers (the so-called white list of VAT payers) using flat file published by the Ministry of Finance. The parameters should be:

typ– number type, one of three possible values [NIP, KRS or REGON] allowed, after which the query will be asked,numer– value of the NIP, REGON or KRS number of the company for which the check is being carried out (required parameter),iban– verified company bank account number (required parameter) in the international IBAN format. Polish bank accounts begin with the country code PL, followed by the 26 digits of the account number. You can use space characters between groups of numbers. Attention! If the country code is not provided, the bill will be verified as Polish.data(optional) – the day on which the verification is to be performed (optional parameter, if it is not provided, the verification will be performed for the current day). Acceptable date format: "YYYY-MM-DD", (example: 2019-09-01),format(optional) – format of the returned data (see: Tags that can be used as the FORMAT parameter).

Calling the function with the NIP or REGON parameter causes the system to directly query the list of VAT taxpayers, which guarantees the fastest status check.

=NIP24.STATUS.WHITELIST("NIP";"7171642051";"PL49154000046458439719826658";"2019-12-01")NIP24.STATUS.WHITELIST.NIP("nip";"iban";["data"];["format"]) – The function checks the correctness of the contractor's bank account number in the list of VAT payers (the so-called white list of VAT payers) based on the NIP and IBAN numbers using a flat file. The description of the input parameters is the same as for the function NIP24.STATUS.WHITELIST().

=NIP24.STATUS.WHITELIST.NIP("7171642051";"PL49154000046458439719826658";"2019-12-01")NIP24.STATUS.WHITELIST.REGON("regon";"iban";["data"];["format"]) – The function checks the correctness of the contractor's bank account number in the list of VAT payers (the so-called white list of VAT payers) based on the REGON and IBAN number using a flat file. The description of the input parameters is the same as for the function NIP24.STATUS.WHITELIST().

=NIP24.STATUS.WHITELIST.REGON("472301670";"PL49154000046458439719826658";"2019-12-01")NIP24.STATUS.WHITELIST.KRS("krs";"iban";["data"];["format"]) – The function checks the correctness of the contractor's bank account number in the list of VAT payers (the so-called white list of VAT payers) based on the KRS number and IBAN using a flat file. The description of the input parameters is the same as for the function NIP24.STATUS.WHITELIST().

=NIP24.STATUS.WHITELIST.KRS("0000030897";"PL17114000001527010928203867";"2019-12-01")Tags available in the above-mentioned functions, which can be used as the FORMAT parameter:

$(UID)– query ID from the nip24.pl system,$(NIP)– NIP number of the company for which the inquiry was made,$(IBAN)– standardized (without spaces) IBAN number of the contractor's bank account that was provided in the inquiry,$(Valid)– feedback whether the bank account is included in the VAT list and assigned to a given contractor: "Yes"/"No" (default if there is no format parameter),$(Virtual)– information about the type of bank account. Two possible values: virtual ("Yes") or standard ("No"),$(Status)– numerical VAT status of the taxpayer:- status = 1, the taxpayer is not on the VAT list (white list),

- status = 2, the taxpayer is an active VAT payer,

- status = 3, the taxpayer is exempt from VAT,

$(Result)– descriptive VAT status of the taxpayer:- The entity with the provided tax identification number NIP is not registered as a VAT payer or the provided bank account is not included in the VAT list (the so-called white list),

- Active,

- Released,

$(HashIndex)– index (sequential number) of the shortcut found in the flat file,$(MaskIndex)– index (sequential number) of the mask found in the flat file (only for virtual numbers),$(Date)– date of checking the connection between the NIP/REGON number and the contractor's bank account number (in the format: yyyy-mm-dd),$(Source)– information about the URL of the flat file used for verification.

Default FORMAT: "$(Valid)”

If the string "JSON", the function will return the complete result as a string JSON, which can be freely parsed and further processed.

Searching and downloading all entity data from the list of VAT payers (the so-called VAT white list)

NIP24.SZUKAJ.W.VAT("typ";"numer";["data"];["format"]) – The function searches for a contractor using the indicated number (Tax Identification Number, REGON, bank account number (IBAN) or KRS number) in the list of VAT taxpayers (the so-called white list of VAT taxpayers) and downloads all data made available via the interface API provided by the Ministry of Finance. The information is being downloaded directly With list of VAT payers (so-called VAT white list) of the Ministry of Finance. The parameters should be:

typ– type of number (NIP, REGON, bank account number IBAN or KRS) by which the inquiry will be asked,numer– value of the NIP, REGON, bank account number IBAN or KRS of the company for which the check is being carried out (required parameter),data(optional) – the day on which the verification is to be performed (optional parameter, if it is not provided, the verification will be performed for the current day). Acceptable date format: "YYYY-MM-DD", (example: 2019-09-01),format(optional) – format of the returned data (see: Tags that can be used as the FORMAT parameter).

Calling the function with the NIP, REGON or IBAN parameter causes the system to directly query the list of VAT taxpayers, which guarantees the fastest status check. Example:

=NIP24.SZUKAJ.W.VAT("NIP";"7171642051";"PL49154000046458439719826658";"2020-03-20")NIP24.SZUKAJ.W.VAT.NIP("nip";["data"];["format"]) – The function searches for and downloads the contractor's data from the list of VAT payers (the so-called white list of VAT payers) based on the NIP number. The description of the input parameters is the same as for the function NIP24.SZUKAJ.W.VAT(). Example:

=NIP24.SZUKAJ.W.VAT.NIP("7171642051";"2020-03-20")NIP24.SZUKAJ.W.VAT.REGON("regon";["data"];["format"]) – The function searches for and downloads the contractor's data from the list of VAT payers (the so-called white list of VAT payers) based on the REGON number. The description of the input parameters is the same as for the function NIP24.SZUKAJ.W.VAT(). Example:

=NIP24.SZUKAJ.W.VAT.REGON("472301670";"2020-03-20")NIP24.SZUKAJ.W.VAT.KRS("krs";["data"];["format"]) – The function searches for and downloads the contractor's data from the list of VAT payers (the so-called white list of VAT payers) based on the KRS number. The description of the input parameters is the same as for the function NIP24.SZUKAJ.W.VAT(). Example:

=NIP24.SZUKAJ.W.VAT.KRS("0000030897";"2020-03-20")NIP24.SZUKAJ.W.VAT.IBAN("iban";["data"];["format"]) – The function searches for and downloads the contractor's data from the list of VAT payers (the so-called white list of VAT payers) based on the bank account number (IBAN). The description of the input parameters is the same as for the function NIP24.SZUKAJ.W.VAT(). Example:

=NIP24.SZUKAJ.W.VAT.IBAN("PL49154000046458439719826658";"2020-03-20")Tags available in the above-mentioned functions, which can be used as the FORMAT parameter:

$(UID)– query ID assigned by the nip24.pl system,$(ID)– unique query identifier returned by the API of the list of VAT taxpayers of the Ministry of Finance (requestId),$(Date)– date for which the search is to be performed in the format: yyyy-mm-dd,$(Source)– information about the address of the service from which the data was downloaded, always: https://wl-api.mf.gov.pl$(EntitiesCount)– number of returned entities,$(Entity[e].Name)– company (name) or name and surname,$(Entity[e].NIP)– company tax identification number,$(Entity[e].REGON)– REGON identification number,$(Entity[e].KRS)– KRS number, if assigned,$(Entity[e].ResidenceAddress)– full address of the registered office with postal code,$(Entity[e].WorkingAddress)– address of the permanent place of business or address of the place of residence if there is no address of the permanent place of business,$(Entity[e].VATStatus)– numerical VAT status of the taxpayer:- status = 1, the taxpayer is not on the VAT list (white list),

- status = 2, the taxpayer is an active VAT payer,

- status = 3, the taxpayer is exempt from VAT,

$(Entity[e].VATResult)– descriptive VAT status of the taxpayer:- unregistered,

- Active,

- Released,

$(Entity[e].HasVirtualAccounts)– information whether the entity has virtual bank accounts: Yes/No,$(Entity[e].RegistrationLegalDate)– date of registration as a VAT payer,$(Entity[e].RegistrationDenialDate)– date of refusal to register as a VAT payer,$(Entity[e].RegistrationDenialBasis)– legal basis for refusal to register,$(Entity[e].RestorationDate)– date of reinstatement as a VAT payer,$(Entity[e].RestorationBasis)– legal basis for reinstatement as a VAT payer,$(Entity[e].RemovalDate)– date of deletion of the refusal to register as a VAT payer,$(Entity[e].RemovalBasis)– legal basis for deleting the refusal to register as a VAT payer,$(Entity[e].RepresentativesCount)– number of returned representatives,$(Entity[e].Representatives)– data of all representatives glued into one string, names and surnames of persons included in the body authorized to represent the entity and their NIP numbers,$(Entity[e].Representatives[r].CompanyName)– name of the body authorized to represent the entity,$(Entity[e].Representatives[r].FirstName)– name of the person authorized to represent the entity,$(Entity[e].Representatives[r].LastName)– name of the person authorized to represent the entity,$(Entity[e].Representatives[r].NIP)– NIP of the body authorized to represent the entity,$(Entity[e].AuthorizedClerksCount)– number of returned proxies,$(Entity[e].AuthorizedClerks)– data of all proxies glued into one string. Names and surnames of the proxies and their NIP numbers,$(Entity[e].AuthorizedClerks[c].CompanyName)– name of the body acting as a proxy,$(Entity[e].AuthorizedClerks[c].FirstName)– name of the proxy,$(Entity[e].AuthorizedClerks[c].LastName)– name of the proxy,$(Entity[e].AuthorizedClerks[c].NIP)– NIP of the body acting as a proxy,$(Entity[e].PartnersCount)– number of returned partners,$(Entity[e].Partners)– data of all partners glued into one string, names and surnames or company name (name) of the partner and his NIP number,$(Entity[e].Partners[p].CompanyName)– name of the partner company,$(Entity[e].Partners[p].FirstName)– partner's name,$(Entity[e].Partners[p].LastName)– partner's name,$(Entity[e].Partners[p].NIP)– NIP of the company that is a partner,$(Entity[e].IBANsCount)– number of returned bills,$(Entity[e].IBANs)– all account numbers glued into one string,$(Entity[e].IBANs[i])– standardized (without spaces) IBAN number of the contractor's bank account.

Where:

[e] – index from the range [1, $(EntitiesCount)]

[r] – index from the range [1, $(Entity[e].RepresentativesCount)]

[c] – index from the range [1, $(Entity[e].AuthorizedClerksCount)]

[p] – index from the range [1, $(Entity[e].PartnersCount)]

[i] – index from the range [1, $(Entity[e].IBANsCount)]

Default FORMAT: "Nazwa: $(Entity[1].Name), NIP: $(Entity[1].NIP), Status VAT: $(Entity[1].VATResult), Rachunki: $(Entity[1].IBANs), Liczba znalezionych rekordów: $(EntitiesCount)”

If the string "JSON", the function will return the complete result as a string JSON, which can be freely parsed and further processed.

Transformation of the KRS, NIP, REGON, IBAN numbers into a standardized form

NIP24.KRS.NORMA() – The function transforms the KRS number into a standardized form. The following parameters should be provided: KRS NUMBER

=NIP24.KRS.NORMA("1280")NIP24.NIP.NORMA() – The function transforms the NIP number into a standardized form. The following parameters should be provided: NIP NUMBER

=NIP24.NIP.NORMA("717-164-20-51")NIP24.REGON.NORMA() – The function transforms the REGON number into a standardized form. The following parameters should be provided: REGON NUMBER

=NIP24.REGON.NORMA("141715362")NIP24.IBAN.NORMA("iban") – The function transforms the bank account number into a standardized form. The following parameters should be provided: bank account number.

=NIP24.IBAN.NORMA("PL 17 1140-0000-1527-0109-2820-3867")Verification of the correctness of the number: KRS, NIP, REGON, IBAN

NIP24.KRS.POPRAWNY() – The function verifies the correctness of the provided KRS number. The following parameters should be provided: KRS NUMBER. Returns TRUE if the number is valid and FALSE if the number is incorrect.

=NIP24.KRS.POPRAWNY("0000001280")NIP24.NIP.POPRAWNY() – The function verifies the correctness of the provided NIP number. The following parameters should be provided: NIP NUMBER. Returns TRUE if the number is valid and FALSE if the number is incorrect.

=NIP24.NIP.POPRAWNY("717-164-20-52")NIP24.REGON.POPRAWNY() – The function verifies the correctness of the provided REGON number. The following parameters should be provided: REGON NUMBER. Returns TRUE if the number is valid and FALSE if the number is incorrect.

=NIP24.REGON.POPRAWNY("14171536200000")NIP24.IBAN.POPRAWNY("iban") – The function verifies the correctness of the provided IBAN bank account number. The parameters include the bank account number. Returns TRUE if the number is valid and FALSE if the number is incorrect.

=NIP24.IBAN.POPRAWNY("PL17114000001527010928203867")Checking the status of the user account in NIP24

NIP24.STATUS.KONTA() – The function returns basic information about the plan currently used by the user. The parameters should be:

- (optional) FORMAT of the returned data (see: Tags that can be used as the FORMAT parameter),

=NIP24.STATUS.KONTA()Attention! Function call does not increase number of queries performed.

Tags available in the function NIP24.STATUS.KONTA possible to use as FORMAT parameter:

$(BillingPlanName)– Name of the current tariff plan$(SubscriptionPrice)– Net price of the monthly subscription$(ItemPrice)– Net cost of a single off-plan query on the standard plan$(ItemPriceStatus)– Net cost of a single inquiry – VAT/VIES/Business status of the entity in the individual plan$(ItemPriceInvoice)– Net cost of a single inquiry – invoice data in an individual plan$(ItemPriceAll)– Net cost of a single inquiry – full details of the entity in the individual plan$(ItemPriceWhitelist)– Net cost of a single inquiry – verification of the entity in the VAT list (white list) in the individual plan$(Limit)– Maximum number of queries in the plan$(RequestDelay)– Minimum time interval between queries$(DomainLimit)– Maximum number of domains (API keys)$(OverPlanAllowed)– Possibility to exceed the maximum number of queries in a plan$(TerytCodes)– Access to TERYT codes$(ExcelAddIn)– Access using the MS Excel add-in$(Stats)– Access to statistics of completed queries$(NIPMonitor)– Access to monitoring entity statuses: VAT/VIES/Business status$(SearchByNIP)– Search by NIP number$(SearchByREGON)– Search by REGON number$(SearchByKRS)– Search by KRS number$(FuncIsActive)– Access to functions checking the entity's activity status$(FuncGetInvoiceData)– Access to functions downloading entity data for an invoice$(FuncGetAllData)– Access to functions downloading full entity data$(FuncGetVIESData)– Access to functions checking the entity's status in the VIES system$(FuncGetVATStatus)– Access to functions checking the entity's status in the VAT register$(FuncGetIBANStatus)– Access to functions checking the status of a bank account using API$(FuncGetWhitelistStatus)– Access to the function verifying the status of a bank account using a flat file$(InvoiceDataCount)– Number of queries made about the entity's invoice data$(AllDataCount)– Number of queries made about the entity's full data$(FirmStatusCount)– Number of inquiries made about the entity's activity status$(VATStatusCount)– Number of inquiries made about the entity's status in the VAT register$(VIESStatusCount)– Number of queries made about the entity's status in the VIES system$(IBANStatusCount)– Number of inquiries made about the status of a bank account in the VAT list$(WhitelistStatusCount)– Number of queries made about the entity's status in the VAT list (white list)$(TotalCount)– Total number of queries completed in the current billing month$(ItemPriceIBAN)– Price of inquiry about account status in individual plan

Default FORMAT: "Nazwa bieżącego planu taryfowego: $(BillingPlanName), Cena netto abonamentu miesięcznego: $(SubscriptionPrice), Maksymalna liczba zapytań w planie: $(Limit), Całkowita ilość wykonanych zapytań w bieżącym miesiącu: $(TotalCount)”

If the string "JSON" is provided as the FORMAT parameter, the function will return the complete result in the form of a JSON string, which can be freely parsed and further processed.

The maximum number of queries in a plan

NIP24.STATUS.KONTA.LIMIT() – The function returns information about the maximum number of queries available in the plan selected by the user. Returns exactly the same number as the $(Limit) tag in the NIP24.STATUS.KONTA() function.

=NIP24.STATUS.KONTA.LIMIT()Attention! Function call does not increase number of queries performed.

Get the number of all queries performed in the current month

NIP24.STATUS.KONTA.LICZBA.ZAPYTAŃ() – The function returns information about the total number of queries performed in the current billing month for a given account (all API keys). Returns exactly the same number as the tag $(TotalCount) in function NIP24.STATUS.KONTA().

=NIP24.STATUS.KONTA.LICZBA.ZAPYTAŃ()Attention! Function call does not increase number of queries performed.