10 most frequently asked questions regarding the National e-Invoice System (KSeF)

1. What is the National e-Invoice System (KSeF)?

National e-Invoice System, abbreviated as KSeF, is an IT system that enables the issuance, transmission, storage and receipt of structured invoices. It introduces a uniform standard for electronic invoices in Poland, which is intended to facilitate and improve economic transactions.

2. Who is obliged to use KSeF?

From July 1, 2024, KSeF will be mandatory for all VAT taxpayers who have their registered office or permanent place of business in Poland. Entrepreneurs exempt from VAT will have to start issuing e-invoices under the KSeF from January 1, 2025. From this date, all taxpayers running a business and supplying products or services to other entrepreneurs will have to use the KSeF. Currently (December 2023), the so-called consumer invoices, i.e. issued to citizens (B2C). After consultations off also from KSeF were:

- Eurocontrol, i.e. airline tickets covered by zero VAT rate (0%) – completely

- Receipts on toll motorways – completely

- Tickets for the journey – completely

3. Who is exempt from using structured invoices?

The obligation to use KSeF and issue structured invoices does not apply to:

- a taxpayer without a registered office or permanent place of business in the territory of the country;

- a taxpayer without a registered office in the territory of the country, who has a permanent place of business in the territory of the country, and this permanent place of business does not participate in the supply of goods or provision of services for which the invoice was issued;

- a taxpayer using special procedures referred to in Chapter XII in Chapters 7, 7a and 9, documenting activities settled under these procedures (Non-EU OSS procedure, Special procedure for the provision of international occasional road passenger transport services, Special procedure for distance sales of imported goods);

- to the purchaser of goods or services who is a natural person not conducting business activity;

- in the case of properly documented supplies of goods or services specified in the regulations issued pursuant to Art. 106s

4. How to issue an invoice in KSeF?

To issue an invoice in KSeF, you must log in to the system using a trusted profile or e-signature. A detailed description of how to create an account and log in can be found in one of our sections A guide to KSeF. Then, complete the invoice data, such as the seller's and buyer's details, the date of issue and sale, the invoice number, the subject of the sale, the sales value, and VAT. After completing the data, click the "Issue an invoice" button. The process of issuing a basic VAT invoice has also been described by us in the KSeF Guide: How to issue your first KSeF invoice.

5. Will people with unregistered activities also have to use KSeF?

Yes - if a person running an unregistered business sells to another entrepreneur, he or she is obliged to issue an invoice to him by KSeF. To use the system, you must have a NIP number.

6. Can KSeF issue invoices in a foreign currency?

Yes, KSeF allows you to issue invoices in foreign currencies. For entrepreneurs conducting international business, it is recommended to use software integrated with KSeF, which will also correctly convert the currency exchange rate to PLN. We would like to remind you that in accordance with applicable law, the exchange rate should be converted based on the average exchange rate published by the National Bank of Poland on the day preceding the date of invoice issuance. Table A of current rates is available on the NBP website: https://nbp.pl/statystyka-i-sprawozdawczosc/kursy/tabela-a/.

It is also possible to call the API to get currency rates:

https://api.nbp.pl/api/exchangerates/tables/A/2023-12-13/

7. Will a foreign contractor have access to KSeF?

No, foreign entities for which an invoice will be issued in KSeF will not have accounts in this system, so the form of transferring an invoice issued in KSeF to a foreign contractor will have to be made outside KSeF, e.g. by sending an invoice visualization in the form of a PDF file using e-mail.

8. Can KSeF issue a pro forma invoice?

No, KSeF does not support pro forma invoices because they are not VAT invoices. The following types of invoices will be accepted under the National e-Invoice System:

- Basic invoice – VAT

- Invoice correction – COR

- Advance invoice – ZAL

- Settlement invoice – SIZE

- Simplified invoice – UPR

- Correction of the advance payment invoice – KOR_ZAL

- Correction of the settlement invoice – KOR_SEC

9. Is self-invoicing possible under KSeF?

Yes, the KSeF platform allows buyers to self-invoice, but the seller must grant appropriate permissions to his contractors, who will be able to issue invoices on their own on behalf of the seller. Detailed information on self-invoicing as an authorization model for the National e-Invoice System can be found on the website taxes.gov.pl. In the bookmark Knowledge base-Files for download there is an information brochure regarding the FA(2) structure of a structured invoice and the KSeF Taxpayer Application User's Manual, which also contains information about self-invoicing.

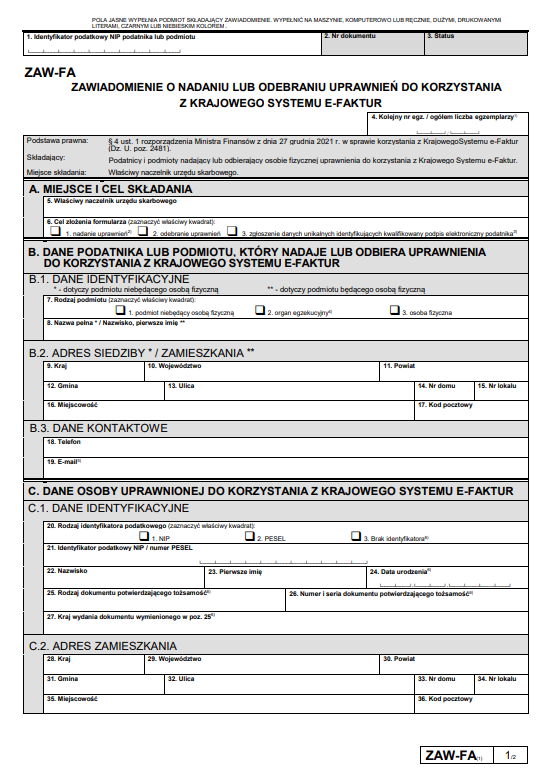

10. What is a ZAW-FA notice and how can it be submitted?

The ZAW-FA notification is a document submitted to the tax office in order to grant or withdraw authorization to use the National e-Invoice System (KSeF).

ZAW-FA notification may be submitted by:

- VAT taxpayers who are obliged to issue invoices in KSeF.

- VAT taxpayers who voluntarily decided to issue invoices in KSeF.

- Entities that grant or revoke the right to use KSeF to another natural person.

A ZAW-FA notification can be submitted as follows:

- Electronically, via the e-Tax Office or ePUAP portal.

- In paper form, at the tax office.

The current template of the ZAW-FA Notice can always be downloaded from the template repository of the Ministry of Finance: VAT printable forms (podatki.gov.pl)