KSeF – everything worth knowing about the National e-Invoice System

Basic information

Ladies and Gentlemen, in this article we would like to collect and present all the most important information that appeared in the public space in 2023 in the context of KSeF and draw attention to the consequences that the introduction of the mandatory National e-Invoice System (KSeF) will cause for entrepreneurs.

The moment when KSEF becomes a mandatory solution is of course no longer the first of July 2024. You can read more about the reasons for postponing the entry into force of the KSeF in one of our previous posts: However, KSeF will not be available until 2025 at the earliest! This means that all entrepreneurs have more time to prepare well for the introduction of the obligation to issue invoices using the National e-Invoice System.

So let's start from the beginning. To understand these consequences, and they will manifest themselves in our everyday practice, which involves us encountering three forms of invoice:

- traditional paper invoice,

- an electronic invoice, in the traditional sense in the form of e.g. PDF,

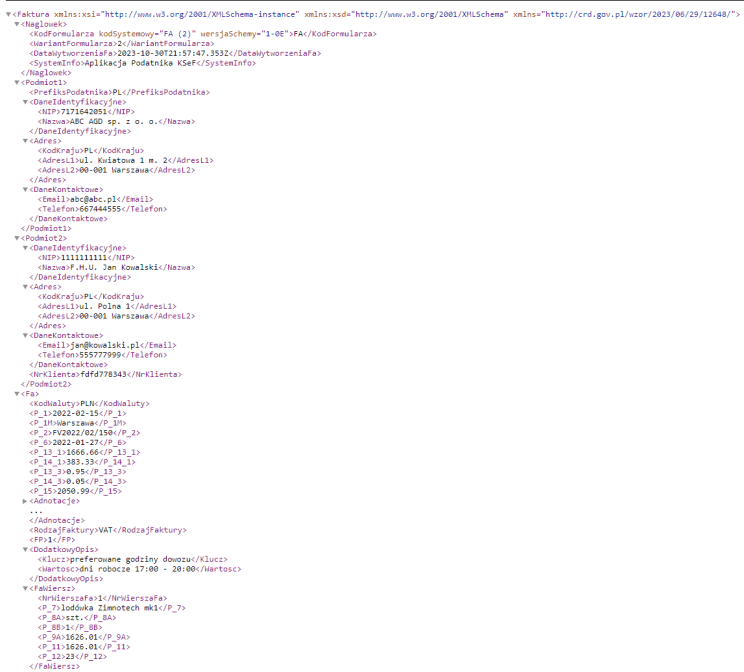

- but also with this new form of e-Invoice KSeF, i.e. with an invoice structured in the form of an XML file.

In order to properly understand the scale of these consequences and their importance, first of all, here is some preliminary basic information that will allow us to find our way in this new reality related to the introduction of the mandatory National e-Invoice System.

KSeF is a central IT system, created, developed and maintained by the Ministry of Finance, through which, when we connect via the Internet, we must be equipped with appropriate IT tools that will enable us to communicate and which is involved in the process of issuing e- Invoices and then archives these invoices. Of course, the invoice must meet certain technical requirements because it is transferred to KSeF in the form of an electronic file (XML format).

What does the entry into force of the KSeF actually mean in practice for individual entrepreneurs?

First of all, we must note that what is most important and will affect active VAT payers first. The question is whether all of them? Postponing the entry into force of the KSeF will not change its assumptions, namely that active VAT taxpayers who are based in Poland or have a permanent place of business in Poland through which they would carry out transactions, will have to use the National e-Invoice System on an obligatory basis. the place of provision of which would be the territory of the country. Other taxpayers who perform activities exclusively exempt from VAT will be obliged to issue invoices using the National e-Invoice System at a later date.

Who does this apply to? This applies to taxpayers who are covered subjective exemption, including due to the limit of PLN 200,000 in revenues, but also taxpayers who only perform activities that are subject to exemption. These entities, these taxpayers will have to start applying and issuing invoices using KSeF later.

What in the case of transactions carried out using cash registers?

If the taxpayer issues invoices using cash registers, then in the scope of this transaction, which will be documented with an invoice issued using the cash register, the taxpayer is responsible for this transaction. it will not there was an obligation to issue a structured invoice.

Another quite important issue that you need to pay attention to is the issue of simplified invoices, including receipts with NIP (Tax Identification Number) up to PLN 450.

During the transitional period - which will certainly be introduced by the government, regardless of the date of implementation of the obligation to use the KSeF - during this period it will be possible to issue simplified invoices outside the KSeF and, of course, there will also be such a simplified invoice function, a receipt with the NIP to value of PLN 450, so transactions that will be documented in this form will also be valid during this transitional period off from the obligation to document it with a structured invoice.

Of course, the question arises as to what extent taxpayers and entrepreneurs will be obliged to issue structured invoices in KSeF?

The general rule is that the obligation to issue an invoice in the form of a structured invoice, i.e. e-Invoice, will cover transactions concluded between entrepreneurs. And note, this is very important information, also in the case of sales made to foreign entities, entities from the European Union or entities from outside the European Union, we will be obliged to document the transaction with a structured invoice issued in KSeF. In such a case, we will only be obliged to provide such a buyer with an invoice (or rather a visualization of a structured invoice, e.g. in the form of a PDF file) in the manner agreed with him (i.e. as before).

To summarize, transactions between entrepreneurs will be subject to the obligation to issue structured invoices using KSeF.

The exception will apply to entrepreneurs who do not have their registered office in Poland, although, for example, they are registered in Poland, or they do not have a permanent place of business in Poland through which they would perform transactions for the buyer. In that case they they will have no obligation issuing structured invoices. The conclusion is that the vast majority of taxpayers based in Poland will have to issue such invoices to KSeF.

KSeF and B2C transactions

An important exception that appears here, an exception to the exclusion from issuing invoices in KSeF, is the documentation of transactions for natural persons not conducting business activity.

Taxpayers who sell to natural persons who do not run a business, they will have no obligation documenting these transactions by issuing a structured invoice and sending it to KSeF. In such a case, the transaction can be documented with a traditional paper invoice or an invoice issued in the form of a PDF file or another electronic form.

The above example shows that we will encounter various forms of invoices before we fully adopt the obligation to issue only structured invoices.

Differences between invoice forms (paper, electronic, structured)

Is it important to distinguish the form of invoice?

To answer directly: Yes, because the regulations that are currently being prepared to enter into force (have already been adopted) specify different legal consequences depending on the form of invoice we are dealing with.

What basic issues should you pay attention to? First of all, we must pay attention to the fact that if we compare a structured invoice (e-Invoice) with a traditional paper invoice or with a traditional electronic invoice (e.g. in the form of PDF), the regulations provide for separate consequences related to date (moment) of issue such an invoice.

Let us remember that in the case of a structured invoice, this moment (of issuing the invoice), i.e. the creation of a document that produces legal effects, has been defined by law. This moment will be the moment of sending (or more precisely, receiving) the invoice by KSeF and assigning it a KSeF number. In the case of a paper or traditional electronic invoice, other than e-Invoice, this will of course be the moment when the document is completed.

It should also be noted that the provisions of the VAT Act will specify different rules for settling corrections related to correction invoices, depending on the type of invoice in a given case and the form in which the invoice is received. It may happen that we will make purchases, e.g. from an entity with the status of an active VAT payer, which, however, not having its registered office in Poland or having a permanent place of business in Poland, will issue us an invoice with VAT and we will receive this invoice in the form of a paper invoice or in traditional electronic form. However, we will receive invoices from most of our contractors in the form of structured invoices using the National e-Invoice System, and we will be able to download these invoices from there.

So of course what is important here is that we are aware of these different consequences.

It should be noted that from the perspective of the form of invoice, legal provisions, but also technical requirements, introduce certain discrepancies between individual forms of invoice. In the case of a structured e-Invoice, issued as a settlement invoice, it will be necessary to indicate that we are issuing this type of invoice in the content of the invoice and provide the KSeF numbers in the content of the invoice, as part of the catalog of information contained in this invoice.

Additionally, if it happens that we share an invoice that was issued as structured in a different form with our contractor or make it available in a way other than through KSeF, the regulations provide for the obligation to place it on visualization such an invoice has a special verification code (QR code), so this also causes a certain specificity of structured invoices. We wrote more about QR codes in the entry analyzing the proposed provisions of the Regulations of the Ministry of Finance related to the introduction of KSeF: Regulations regarding KSeF - analysis of two published draft regulations on the organization of the National e-Invoice System (KSeF). We encourage you to read the content of the entry and supplement your knowledge regarding QR codes in the visualization of KSeF invoices.

A characteristic but very important element of issuing invoices using the National e-Invoice System is that we will not be able to send attachments to KSeF along with the invoice. It will be possible to send references, or simply put, a link to attachments that are important from a business point of view for a given entrepreneur, such as a document confirming the order.

The previously mentioned three forms of invoices that will appear in trade, of course on what scale for individual entrepreneurs, and what forms of invoices we will deal with, depend on the specificity of a given entrepreneur, on the specificity of his business activity.

We very often deal with entrepreneurs who make most of their sales to natural persons who do not run a business, so issuing KSeF invoices for such entrepreneurs will be much more limited, because the specificity of the business will be such that such invoices in KSeF (B2C) they will have no obligation issue for their customers who are consumers.

However, those companies that cooperate only with entrepreneurs, of course, will have to issue fully structured invoices.

Three forms of invoice mean the need to implement appropriate procedures in the company related to issuing and receiving invoices so as to be prepared to use, in appropriate cases, those specified in the regulations, and in cases resulting from the regulations, the appropriate form of invoice.

Will there be entities that will not have to implement KSeF and what about foreign contractors?

If someone is an entrepreneur, there is basically no case that they will be able to afford not to implement KSeF. Well, when we function as a VAT payer, we may always encounter a situation where we will sell to a person who would not sell to entrepreneurs, i.e. who would only sell to natural persons who do not run a business.

Will all industries be covered by the KSeF system? Yes, there are no exclusions here due to industries and foreign contractors.

Cooperation with foreign contractors means cooperation in the field of sales and purchases. The question is, what should we pay attention to in the context of KSeF? Sales made to foreign entrepreneurs will be subject to the obligation to issue structured invoices to KSeF. But how can a foreign contractor download an invoice from KSeF if he is not obliged to use the National e-Invoice System? We will be able to forward these types of invoices to the contractor in the manner agreed with him. This can also be a traditional paper invoice (printout of a structured invoice visualization) or an electronic invoice in the form of a PDF file (structured invoice visualization). This situation occurs when issuing a sales invoice, but when making purchases from foreign entrepreneurs who have the status of an active VAT payer, we must be aware that their status as an active VAT payer will not automatically mean that we will receive an invoice from them via KSeF. It should be assumed that in 99% cases we will still receive an invoice from foreign contractors in paper or electronic form (PDF). Because a foreign entrepreneur will be obliged to issue invoices to KSeF only if he has a permanent place of business in Poland through which he carries out the transaction.

Therefore, it may happen that, as part of cooperation with foreign contractors, we will of course use invoices in a form other than a structured invoice. However, remember that when selling to entities from the European Union or outside the EU, we will have an obligation issuing an invoice using the National e-Invoice System.

Structured invoice (e-Invoice), KSeF invoice

What is it and what are its features? A structured invoice as defined in the VAT Act is characterized by certain specific features.

Of course, as a rule, it is a type of electronic invoice. This structured invoice, e-Invoice - we can use these names interchangeably. This is an invoice that was issued using KSeF, i.e. the National e-Invoice System was involved in the process of issuing the invoice.

The invoice issue date is defined in such a case in the law, i.e. this moment date of transfer (influence) invoices to KSeF.

What other feature characterizes a structured invoice? One such feature is undoubtedly the number assigned to each invoice received by the KSeF system. Remember, the number assigned to the invoice by the KSeF system is a separate number than the number we assign to the invoice on our side, in our system, to distinguish it from other invoices.

Therefore, a structured invoice is characterized by having two numbers. Our number assigned to such an invoice and the number assigned to such an invoice by the KSeF system, when KSeF accepts this invoice, will verify its technical compliance with the requirements for a structured invoice and save it in its repository.

Of course, e-Invoice is characterized by the fact that its content must include information and data required by law, in an appropriate manner in terms of organizing this information. This way of organizing is a diagram, structure, of a structured invoice.

The original form of e-Invoice is an electronic file, a structured invoice in the form of an XML file, and the content of the information contained in the invoice is appropriately organized in this structure according to the scheme required for a structured invoice. Currently, this is the second version of the scheme Central Document Repository.

Therefore, the original form is a file with saved data, according to the appropriate structure (XSD schema) in XML format.

As you can easily guess, an XML file is a document that is difficult for a human to work with, so in the context of a structured invoice the concept of visualization. Therefore, the information stored in the XML file is processed by an appropriate IT tool so that we, as people, can easily read the information presented inside the XML file in the structure of a structured invoice.

What should you pay special attention to from the perspective of structured invoices?

It should, of course, be remembered that the moment of issuing such an invoice is normatively defined, i.e. the moment of its issuance, the moment of creation of this document in the legal sense, and at the same time the moment of entry of this document into legal circulation, because at this moment the document is basically transferred to the contractor, i.e. the moment of sending her to KSeF.

This is the moment of exposure. And now KSeF (after receiving the invoice) verifies the technical compliance of the document with the technical requirements for a structured invoice. After such verification, if it is positive, it assigns a number to the invoice, saves it in its archive and the moment of assigning the KSeF number is also the moment of receipt of the invoice by the buyer. This is the moment of receiving the invoice, which is defined in the legal sense, and therefore it is a separate moment than the moment of receiving an invoice in paper form, or the moment of receiving an invoice in electronic form, other than using the National e-Invoice System.

What else is worth paying attention to and what should you remember? The structure of a structured invoice is prepared for issuing various types of invoices. However, of course, when issuing a specific invoice documenting the performance of a service, an invoice documenting the receipt of an advance payment, a settlement invoice, a corrective invoice, a corrective invoice for an advance payment, a corrective invoice for a settlement invoice, we must, when issuing such an invoice, enter such information in the content of the structured invoice in the appropriate field, i.e. what type of structured invoice we exhibit. Based on the given type, the KSeF system knows which fields in this invoice should be verified as mandatory and which should be completed.

Procedure in emergency situations

While functioning during the mandatory KSEF period, the entrepreneur must be prepared to function in various cases, as if in various situations.

What's going on here? First of all, you should be aware that we may deal with invoices in various forms, both on the sales side and on the purchase side. Employees in the company must know what this means and what consequences it causes, especially in terms of identifying the moment of receiving an invoice or the moment of issuing an invoice.

Additionally, we must note that the regulations governing the operation of the mandatory national e-Invoice system also provide for the possibility of extraordinary situations occurring under which it will not be possible to issue a structured invoice, despite the taxpayer's obligation to perform such a standard procedure. Such extraordinary cases may occur in the event of service work in the KSeF, in the event of a KSeF failure, but we may also encounter failures about which messages will be provided by the system itself, or using the accompanying interface, or on the website of the Ministry of Finance. with a failure in a qualified form, i.e. such a total failure that the only information that is transmitted about such a failure can reach us through the mass media, for example the radio.

And, of course, another extraordinary situation is the inability to issue an invoice for reasons attributable to the taxpayer. We must be aware that each of these situations has its own characteristics and in the event of each of these situations, the taxpayer must behave appropriately.

In the case of service work, in the event of such an ordinary failure, we issue invoices according to the template for a structured invoice and we are to send such an invoice to KSeF within a specified period of time after its issuance.

This issuance will actually come down to its preparation and submission to our contractor. When it comes to a qualified failure, i.e. a total failure where everything does not work, for example there is no electricity at all, the Internet does not work at all, so of course in such a situation the taxpayer will be entitled to use a classic paper invoice to issue classic paper invoices or classic electronic invoices.

In the event of a failure on the taxpayer's side, this is very interesting and, in a sense, very disturbing, because the current regulations provide that if the taxpayer has problems with issuing e-Invoices, the taxpayer will have to submit the e-Invoices to KSeF the day after its issuance. Not after the failure, which occurred on the taxpayer's side, has ended, but after the day it was issued, so it is also worth paying attention to this.

Substantive verification, something that KSeF will not do for us

As before, it is crucial when using invoices to ensure the substantive consistency of the data presented on the issued invoice with how the transaction actually took place, and of course, from the perspective of purchase invoices, it is crucial that we verify the substantive correctness of the purchase invoice and the validity of its issuance to us as an entrepreneur.

Please remember that receiving a cost invoice from KSeF will not guarantee that the invoice was issued to you legitimately and that it correctly describes the transaction to which it relates..

Therefore, as before, it will be necessary to organize appropriate processes, verify purchase invoices in terms of the validity of issuing the company's name and the correctness of the transaction description included in such a purchase invoice.

Go live KSeF (2025) and what then?

Running a business in the era of mandatory KSeF will force us and the company's employees to be more vigilant, which can be called KSeF tax awareness. What is it about? We will have to be aware that when issuing a structured invoice, the issuance is directly related to the fact that the invoice is sent to KSeF, so when we issue a structured invoice, this invoice will enter legal circulation. This will mean that if any error appears on this invoice, we will have to issue a correction invoice in the form of a structured invoice. And go through the entire procedure of issuing a structured invoice. We must, of course, be prepared for these unusual situations related to the inability to issue a structured invoice due to problems occurring on the National e-Invoice System or due to problems occurring on our side.

The importance of IT tools

The national E-Faktur system, an IT system that participates in the process of issuing invoices, archives these invoices, enables downloading invoices, forwards invoices to buyers, and yes, allows buyers to download invoices.

Only the largest enterprises will have direct access to the National e-Invoice System. In order to cooperate with this system, to use the National e-Invoice System, most entrepreneurs must have appropriate IT tools that will support their work, their exchange of information with the National e-Invoice System, their process of issuing invoices, the process of downloading purchase invoices, but also supported them in the process of granting, receiving and managing permissions to use KSeF by users who will connect to KSeF on behalf of the companies they employ or represent.

It is also worth noting that when it comes to IT tools, they will also be able to support us in the processes of issuing invoices, as if to support us in the process of issuing invoices to ensure substantive reliability and correctness of the data presented in the invoice we issue. , but they will also serve to support us in the process of verifying the substantive correctness of purchase invoices.

It is also important whether a given tool can automate some activities, e.g. by downloading contractor data and completing the appropriate invoice fields for the user. No less important is integration with the white list of VAT taxpayers and other external systems such as REGON, KRS, CEIDG or European VIES.

All these additional functionalities are definitely worth paying attention to when choosing the tool you want to use to integrate with KSeF. We encourage you to choose proven suppliers who have been operating in the industry for many years and have a number of integrations in their portfolio and offer ready-made tools, such as programming libraries, applications or provide a dedicated REST API interface. We are aware that price also plays an important role in choosing a solution, but please also take into account the availability of documentation, SLA, i.e. the level of guaranteed services and technical support offered by a given integrator.

Finally, let us hope that when we successfully go through the process of implementing the national invoice system and these new solutions, when we get used to the new business reality in which we will have to operate in a year's time (read more about the postponement of the entry into force of the KSeF in our article ), this will actually be a beneficial solution for us as entrepreneurs. When we properly prepare for it, implement appropriate procedures, equip ourselves with the necessary knowledge and appropriate IT tools adequate to our needs.

Wishing you quick and trouble-free integration with the National e-Invoice System, we encourage you to familiarize yourself with the offer of tools provided by our website.